Developed Nation Savings

You are here: /announcements/developed-nation-savings

People are often afraid to talk about money. There's never enough of it, they need more, their savings probably look small. There is always more things to buy and the bills just keep piling up.

Realistically, a 15-17 year old should have about $5k dollars saved and spend just a few dollars here and there. Going out with 10 friends who each bring $100 with them exemplify's the context of a situation on how much money people need besides rent, food and utilities. Lets asume a teenager carries $40 on them when they go out with friends during school nights. Mostly emergency money, they likely won't spend it every day, maybe a few bucks here and there. During the Summer, they may have 3-5 events planned that are about $100 each. The rest of the time, they are at home, at school, with their friends but not spending money, working, or doing chores.

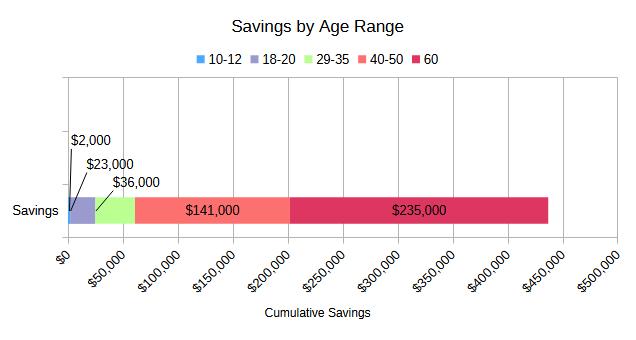

While it may seem absurd to grandma and grandpa. A 10 year old doing $10 chores can easily accumulate $1,200 to $1,500 in 1 year if they put it all in the piggy bank. They may want to buy a video game console or go to a theme park. Figure 10 chores per month, twice per week, sometimes they ask for $25, sometimes they only get $5.

Even at 1 chore per week, at $10 to $15, this can add up to $780 plus birthday presents and christmas. 10, 11, 12. Savings.

This puts them in a good situation to understand work, savings, and personal expenses. They might invite their friends to ice cream or ask if they can buy a birthday present and how big it should be?

At age 14 to 18, they can work but are still in school. They can officially be on a payroll and get direct deposit. They can have bank statements and a debit card. They might also have a piggy bank, and still ask to do chores.

If they aren't spending all their money the minute they get it, they have a first apartment to rent or lease, and a car to buy. Some kids will live with mom and dad for 10 years and immediately buy a house. This is getting rarer, so money management is getting more important.

From 18-20 they are no longer in school. If they decide work full time with their high school diploma, and they live with mom and dad, they might have to pay for food, clothes, and a little bit of money with friends. Maybe $100 still and the bigger events are less than $500. They might have a pretty nice looking savings account when they move into their first apartment.

Online college is also becoming more popular, this allows studying at home, there are virtual meetings or completely asynchronous. This resembles a task list and the teacher or professor can be emailed for questions. If they live on their own, they will likely qualify for financial aid as an independent student. They may only have to work part time, or if they are lucky, they may not have to work while in school. It all depends and requires some budgeting.

The final equation is graduating or completing the program and finding a job that pays more than just rent, food, and utilities. A lot of people create a budget and then a spreadsheet with services or products they can sell online or in person. This is super popular and a big part of the economy. Other students will be able to approach an employer with a more serious conversation about how much money they need each month and throughout the year. Savings and income are a big part of future economies, there may not be that many government programs or assistance. Mostly loans or low cost housing, maybe with roommates and restaurants nearby.

Older people will recognize these numbers because they were frugal and saved. They may have been a little more fortunate in their childhood. Nowadays, these numbers are more realistic of working class families, $100k income being considered upper working class. The middle class is likely in the $500k to $600k per year income bracket. Nobody really uses terms like these anymore and people that make over $1M per year will normally still consider themselves working class.

The numbers provide some insight on what to expect in the near future for money sitting in a savings account. Stock trading and investments are normally done as a full time job by independent workers for themselves unless they are managing a benefits account for an employer. The economy is changing, and this should answer some questions that people often ask. It might also help with measuring goals short term.

All Rights Reserved. Copyright © 2019-2025.